Personal finance often feels like a daunting challenge. But it doesn't have to scare you. With the right strategies, you can build financial freedom.

Start by building a budget that fits your needs. Track your revenue and outgoings to get a clear picture of your finances.

After budgeting,, look into ways to cut costs. Set financial goals, whether it's buying a home.

Remember, mastering your money is a ongoing journey. Be patient, stay determined, and celebrate your successes along the way.

Mastering Your Money: A Budgeting Guide

Taking charge of your finances can feel daunting, but it doesn't have to be. Creating a budget is the key step towards achieving financial stability and reaching your objectives. A well-structured budget enables you track your income and expenses, helping you to make informed decisions about your money.

- Start by identifying all sources of income.

- List every expense, big and small.

- Classify your expenses into sections.

- Set realistic spending limits for each category.

- Evaluate your budget regularly to confirm it's still effective.

Bear this in mind that budgeting is a continuous process. Modifications are often required as your lifestyle change. By adopting these basic principles, you can gain control of your finances and strive towards a more secure financial future.

Financial Literacy 101: How to Invest for the Future

Embarking upon the world of investing can seem daunting, especially if you're just starting out. However, remember that building wealth is a marathon, not a sprint. Prioritize on learning the fundamentals and hone a long-term investment strategy.

One of the key principles of investing is diversification. By distributing your investments across different asset classes, you can mitigate risk and increase your chances of success.

- Consider investing a mix of stocks, bonds, and real estate.

- Learn with different investment options and discover those that align with your investment objectives.

- Don't shy away to seek advice from a financial advisor who can provide personalized guidance.

Remember that investing involves risk, and past performance is not indicative of future results. Remain disciplined, reinvest your earnings, and tolerate the ups and downs. Over time, you can build a solid foundation for financial independence.

Strategies for a Debt-Free Life

Climbing out of debt can seem like an insurmountable challenge, but with the right strategies, it's entirely achievable. The key is to create a personalized framework that addresses your specific financial situation and responsibilities. Start by analyzing your current spending, identifying areas where you can trim costs. Consider tracking your finances to gain better control over your revenue and costs.

- Negotiate with your creditors about potentially reducing your interest rates or creating a more suitable payment plan.

- Consolidate your financial obligations into a single arrangement with a lower interest rate. This can simplify your contributions and potentially save you money over time.

- Explore credit counseling programs offered by reputable organizations. These programs can provide guidance, support, and tools to help you control your debt effectively.

Bear in mind that getting out of debt takes time, discipline, and steadfastness. Stay focused on your goals and celebrate your successes along the way. By taking proactive steps, you can resolve your debt and achieve lasting financial stability.

Saving Smart: Achieve Your Financial Goals

Want to reach your financial dreams? It all starts with strategic saving. A well-crafted savings plan can help you budget for the future, even if it's a retirement fund. Begin by recording your spending to understand where your money is going. Then, define realistic goals and create a budget that allocates funds for both essential needs and savings. Don't forget to consider different saving methods, like high-yield savings accounts or Personal Finance Management investments, to make your money work harder for you.

Personal Finance Planning

Securing your financial future is a vital aspect of living a fulfilling life. Embark on this journey by creating a personalized finance plan that matches with your goals. Determine a budget that records your income and expenditures. Regularly review your financial status to pinpoint areas for optimization.

- Consider diverse investment avenues that suit your risk appetite.

- Diversify your investments across various asset classes to minimize risk.

- Focus on building an emergency fund that can support unexpected costs.

Remember that financial planning is an ongoing journey. Continue informed about market trends and adjust your plan as needed to attain your long-term goals.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Joshua Jackson Then & Now!

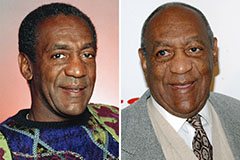

Joshua Jackson Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!